2020 was a significant year for the legal cannabis industry. The space continues to expand and evolve rapidly with new dynamics every day.

A Growing Industry

2020 was a highly momentous year for the legal cannabis industry in the United States From being deemed essential at the onset of the pandemic, to legalization measures passing in five more states, the space continues to expand and rapidly evolve. Each day we observe new and unexpected dynamics, and growing opportunities on a global level In the U.S. alone, the legal cannabis market across all channels is projected to reach $41 billion by 2025.

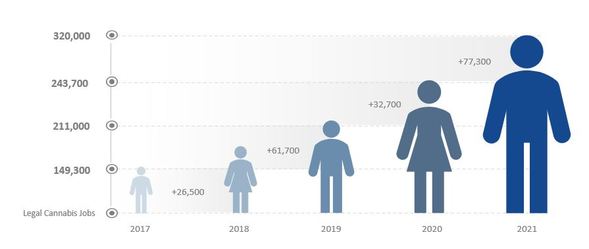

Leafly’s fifth annual cannabis jobs report shows the cannabis industry projected to support 321 000 full time jobs in 2021 The report illustrates that there are more legal cannabis industry professionals in the United States than electrical engineers, EMTS and Paramedics as well as more than twice as many dentists!

Cannabis Job Creation in the United States since 2017

Source: Leafly US cannabis Jobs Report

While the evolution of the U.S. and Canadian markets have a number of differences, there are many lessons learned in the Canadian talent sphere that can help you better predict and navigate the needs of your business in the U.S. In Canada, we’ve been through extreme highs and lows in just a few short years – and it’s safe to say everyone who has made the leap to cannabis has a few stories to tell!

The major motivating factor for many Canadians who joined the industry was the opportunity to shape and influence the federal legalization of cannabis in Canada, ultimately doing something which had never been done before. Making the decision to join such a unique industry requires a high threshold for risk and volatility and is driven by passion and entrepreneurialism.

The Dawn of Legal Cannabis in Canada & its Impact on Employment

The heightened commercial momentum around cannabis in Canada was triggered by an October 2013 set of laws & regulations called the Marihuana for Medical Purposes Regulations (MMPR). Put in place by the federal government, MMPR focused on the production and distribution of medical cannabis. It was in this year that Bruce Linton and Chuck Rifici founded Canopy Growth. In 2016, cannabis legalization took another big step forward when the Access to Cannabis for Medical Purposes Regulations (ACMPR) replaced the MMPR. In 2018, the Cannabis Act was created with regulatory updates for both medical and recreational cannabis users and was designed to better protect the health and safety of Canadians, to keep cannabis out of the hands of youth, and to keep profits out of the hands of criminals and organized crime.

According to Deloitte “the Canadian market for edibles and alternative cannabis products is to be worth C$2.7 billion annually – with cannabis extract-based products including edibles accounting for C$1.6 billion alone.”

As cannabis regulation and the industry as a whole developed in Canada, so did the candidate base and their skill sets. In 2016, individuals started to jump into the industry with excitement and optimism. We saw a mass hiring spree as cannabis firms pulled quality assurance and R&D talent from the pharmaceutical and food industries. The next wave of hiring came from beverage & alcohol and other regulated sectors. The most recent demand has been for consumer-packaged goods (CPG) executives with experience in large-scale manufacturing and retail leaders with expertise in launching new brands, ecommerce, and strategic planning and allocation of product. Every phase in this evolution had an impact on employment and recruitment.

1. Right Sizing after the Initial Boom:

We observed a major shift in the industry as early as mid-2019. The early, extensive M & A activity resulted in layoffs and leadership changes throughout 2020. Cannabis companies were required to professionalize quickly, maneuvering and adapting to regulatory updates and changes. As the core focus of businesses shifted from one of raising capital, to that of productivity and profitability, numerous firms also saw executive and C-level changes, with many start-up founders exiting the business. In addition, many professionals left in search of calmer waters, often returning to the industry from which they originated.

2. Product Expansion – Cannabis 2.0:

The year after legalization brought the launch of Cannabis 2.0—and as edibles, topicals, and concentrates started to show up on dispensary shelves—so did the imminent need to hire leaders from other regulated industries. A new wave of professionals from CPG entered the cannabis workspace as the industry focused on product diversification, consumer education, and customer experience while functioning in a highly regulated environment. Throughout 2020, many consumers moved away from dried flower and vape products, causing an increase in sales of cannabis concentrates and edibles.

3. International Powerhouses Emerge:

Consolidation reigned on both sides of the border, with a rise of multi-state and global cannabis brands. M & A activity continues to heat up in 2021, especially since the U.S. presidential election. Many anticipate, due to the Biden administration’s pro-cannabis stance, that there will be a new wave of legalized state markets and investor interest.

In December 2020, Canadian cannabis industry mergers were taken to another level when Aphria merged with Tilray, creating the world’s largest (revenue based) cannabis company worth over $3.9 billion. Although there are over 600 licensed cannabis operators across Canada today, analysts predict “that as the Canadian cannabis market matures, roughly a handful of companies will control between 70% to 90% of the market.”

4. Leveraging E-commerce and Retail Talent:

COVID-19 created significant opportunities for cannabis retailers who, once encumbered by marketing and delivery regulations, have been pushed to eCommerce platforms, curbside pick up, and contactless delivery. Cannabis firms have brought on former retail executives to drive brand development and consumer loyalty, as well as supply chain leaders with expertise in industrial manufacturing and mass distribution.

Cannabis tech companies have bolstered this digital boom by introducing new products to improve the customer experience and help cannabis brands and retailers maximize their resources. This has pushed cannabis closer into the mainstream, and brands closer to the consumer.