Functional Competencies and Behavioral Attributes Critical for Success

Executive Summary

Some consider the skill set of the Chief Financial Officer (CFO) to be more “portable” from industry to industry or business model to business model than other senior level members of the executive team. Based on the experience of our clients in the Private Equity Practice, the core financial acumen and analytical competencies of an effective CFO can be appropriately applied in different industry or business settings; however, their success will depend on a multitude of situational factors. Is the CFO who successfully partnered with the CEO to grow a company and related infrastructure from $25 million to $100 million qualified to do the same in a company growing from $250 million to $1 billion? Perhaps not. Stage and proof points from prior experience matter.

Core financial functional expertise must be coupled with strong leadership skills and a tight cultural fit that meets the inflection point of the business. While the determination of the best profile for any executive role is situational, success will always hinge on the successful assimilation of the CFO into the company, its culture, and onto the executive team. DHR has isolated certain characteristics of successful CFOs that are routinely defined by our clients as critical for success in private equity sponsored companies (regardless of industry focus or strategy).

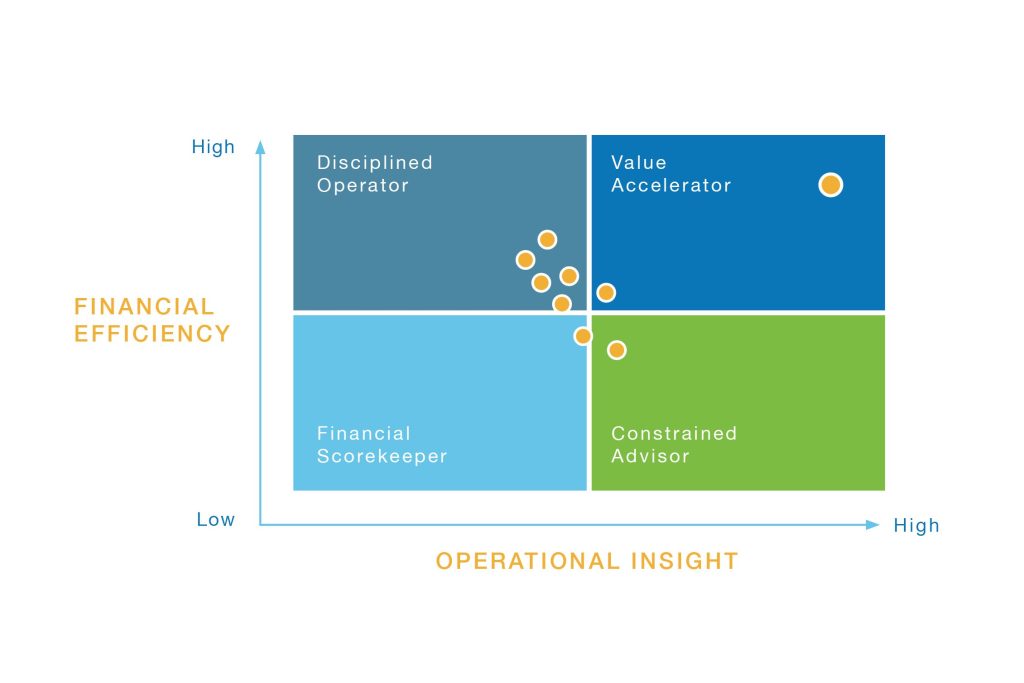

Find Value Accelerators

CFO Value Accelerator Best Practices

- Strong business insight and influence

- Expert operational analysis, planning & forecasting focused on cash flow

- Leveraging data & analytics (internal & external)

- Customer collaboration / understanding

- Process excellence / continuous improvement

- Natural partnering mentality working with CEO, board, peers

Effective Partner to CEO

The CFO is an effective leader and organizational manager acting as a partner to the CEO and focuses on specific strategic and operational initiatives that support the well-defined value creation objectives of the business.

Great CFOs know how to engrain the analytic engine of finance into the fabric of the business. They and the overall finance team help focus the entire business on key financial objectives that support the value creation plan of the entity – moving from reactive measurement to proactive forecasting and analysis, while not losing sight of the basic accounting and control functions. Thus, the CFO must not only have tremendous analytical skill and financial acumen working with the CEO and the Board, but he or she must have deep organizational management skills to build relationships with business peers and cultivate a motivated finance team to operate in a manner that supports the key objectives of the business (as opposed to basic reporting and accounting).

“Technical financial skill is critical, especially here, where we are very active in M&A, balance sheet management and have more than 30 companies under management. However, I have to manage a team to be highly motivated and work closely with others. It is also critical that I build and maintain strong relationships with our CEO, our unit Presidents, our unit Controllers, my peers as well as the Board in executing my duties. Strong management and communication skills are a must in delivering the results that our shareholders expect.”

– Greg Rufus, former EVP & Chief Financial Officer, The Transdigm Group

(NYSE: TDG, former PE sponsored by Odyssey and Warburg Pincus)

Analytic Intellect

The CFO has a quantitative intellect and fluency with numbers that enables effective management of the controller and accounting functions, but does not need to be fluent in the intricate mechanics of accounting and must frame information in a manner that allows for effective decision-making.

It would be impossible for a CFO to succeed without the numbers-oriented analytical skill that allows him or her to effectively manage the overall functions of the organization, especially the controller function. However, in most cases a CPA and/or deep accounting experience is not needed to succeed. While it would be unfair to assume that an executive steeped in accounting cannot rise to the strategic and operational capabilities required to partner well with the Board and CEO, the broader and more strategic training that comes from more generalized business experience, and perhaps MBA education, may be more suitable. Great CFOs need to manage accounting, not understand every detail of the accounting process, but will require a very strong executive who occupies the Controller role for the company.

“CFOs must complement the entire management team by providing them the correct framework to make the best long-term financial decisions. Even subjective issues can and must be framed into this analytical approach. Ultimately the entire team must understand the key drivers of success but the CFO has a fundamental role in insuring that the team has the right perspective when ultimately making decisions. This is definitely not black and white – subject to debate — which makes the role of the CFO even more critical to the success of the business.”

– Christopher Torto, CEO of Ascenty, PE sponsored by Great Hill Partners (Prior, serial CEO of PE funded companies with multiple liquidity events, including IPO)

Cash Flow Driven

The CFO knows how to manage and improve a business with a leveraged balance sheet focusing on cash flow as the key indicator of entity health.

Unlike some environments, PE funded companies are aligned with the Board, CEO, and management in driving a return on investment scenario that is positive for all stakeholders along the way. Typically, the investment thesis includes some meaningful leverage in the business to achieve business results. Thus, the company must pay down debt as part of its daily, weekly, and monthly objectives, and the CFO must see this as a critical part of the team’s charter. As the company drives towards liquidity via sale or IPO, the finance team must focus the organization on both cost and revenue-related activities that lead to increased and sustainable profit and cash flow post-acquisition.

“Companies have different growth objectives and margin profiles, but when the balance sheet is leveraged, as with LBO’s, the CFO’s experience and fluency in managing cash flow and debt service is critical. By keeping their finger on the pulse of their cash flow, the CFO is intimately aware of the health of the business in various economic environments and can timely calibrate appropriate expansion or contraction activity to support the ongoing viability of the business.”

– David Dyckman, Advisory Director, Greenbriar Private Equity (Prior, Executive Vice President & COO and former CFO at American Tire Distributors, PE sponsored by TPG amongst others)

Effective External Manager

The CFO is not just a strong internal manager, but is also effective working with banks, capital market players and outside service providers (like audit firms) as part of their team’s duties.

CFOs and their team must know how to deal effectively with the players that require proper management of cash flow and proper capitalization along the way, both critical to a healthy balance sheet at all phases of the company’s performance against the agreed upon value creation plan. This includes working with banks and other entities who have provided the debt associated with the business. The CFO and their team must also work constructively with institutional investors during capital‐ raising activities, investment banks during public offerings, and audit firms that ensure proper compliance during the life of the investment while private.

“The externally-facing duties of the CFO are just as important, if not more important in some situations, than the CFO’s internally-facing responsibilities. For many external constituents, the CFO is the face of the company and in that capacity, needs to have a deep understanding of not only the financial picture, but also the strategic direction of the enterprise and how that strategy will drive future growth and value for the company’s investors. In conveying that message and working productively with various constituents, it’s also critically important that a CFO have strong interpersonal skills to be able to build long-term relationships and the trust that’s integral to any effective long-term partnership.”

– Fred Pensotti, Serial CFO working in PE-sponsored and public companies, with notable experience as CFO at Interline, PE sponsored by Goldman Sachs and sold to Home Depot

Innately Curious

The CFO is innately curious, with a keen eye for continuous improvements steeped in the development and deployment of Key Performance Indicators (KPIs) that measure and therefore promote profit and cash flow.

The most effective CFOs want to learn and develop a truly in-depth understanding of the business and how to create value. Innately curious and focused on profit, the CFO is maniacal in developing the metrics that reflect and ultimately help predict true business performance, deploying and adjusting KPIs, working with the general managers, running the business, and activating the finance team to provide the objective measurements, systems, processes, and controls that will yield continuous improvement in the business for the long-haul. Importantly, this is not a static process; KPIs must be monitored, adjusted, and improved as business conditions evolve.

“One of the critical priorities for CFOs is not only prioritizing new investments, but also driving the organization to make trade-offs; specifically, helping the business to stop what is not working. This is often hard as once things are in motion they tend to stay in motion. It is so important for the CFO to own the economic model — to be constantly educating the entire organization so that every decision made considers it and the implications to it.”

– Chris LaFond, Chief Executive Officer and former Chief Financial Officer, Insurity (PE sponsored by GI Partners)

Thinks Like an Owner

The CFO, like the CEO and others on the executive team, thinks like an owner of the business.

In summary, great CFOs of private equity sponsored companies think like an owner of the business and apply a willful long-term management approach that results in “followership” throughout the organization (not just the finance organization) in the fulfillment of their duties. Investment-related decisions are driven by a thoughtful, fact-based, and strategic process that aligns with the value creation plan – a process where capital is spent wisely and intelligent resource allocation is the mantra. Accordingly, there is rigor in determining when to spend money on what and how it supports business priorities and financial transparency along the way. Equally important, there is tremendous emphasis placed on measuring the accuracy of financial decisions tied to verifiable business results with well-defined KPIs that align with the value-creation plan. There is a “closed loop” where real time learning and continuous improvement feed the evolving strategy and value creation plan of the business.

“While we want everyone on the management team to operate like a true owner, it is arguably even more critical for the CFO. Acting as the financial conscious for the company, our CFOs help us control costs, drive efficiencies and, working closely with the CEO and the Board, help intelligently transform the business with well thought out investment decisions tied to growth initiatives.”

– Rob Small, Managing Partner, Stockbridge Capital (public equity fund) and, prior, Managing Director, Berkshire Partners (private equity)

Meet the Author

Keith Giarman

Managing Partner, Global Private Equity Practice

Keith Giarman serves as Managing Partner of the Private Equity Practice, based out of the San Francisco and New York offices. He is also a member of the firm’s North American Executive Committee driving overall strategy for the organization.