The telecommunications industry has historically been at the vanguard of change, both in applying cutting-edge technology to its own infrastructure and operations, as well as pushing bleeding edge services to its customers. In particular, over the past 50 years, communications service providers (CSPs) have faced a non-stop evolving business and technology environment. A shifting regulatory environment and lightspeed advances in services have created an incredibly dynamic and competitive market environment.

The Constant Pursuit of Growth

Over the last decade, traditional revenue streams from voice, messaging (SMS), and data have constantly hit up against ever stronger downward pricing pressure, fueled by regulator-mandated competition and intensifying customer expectations. While telcos have scored notable wins in the track record of adaption to previous game changing developments — including the internet explosion and the emergence of cellular mobile communications in the 1990s — they seem to have missed the race when it comes to solutions from over-the-top (OTT) providers and the challenges presented by the Internet of Things (IOT).

The Internet of Things (IoT) is an aggregation of endpoints — or “things” — that are uniquely identifiable and that communicate over a network without human interaction using some form of automated connectivity, whether locally or globally.1

Both OTT and IOT offerings exploit carrier infrastructure and cannibalize traditional revenue lines (such a mobile and fixed line data) and have a cascading impact on the industry. Adapting to this points to the need for transformation within the telco ecosystem. For carriers, it is the era of “adapt or be forgotten”.

International Data Corporation’s (IDC) digital transformation (DX) model recognizes five dimensions of transformation: Leadership, Omni-experience, Information Management, Operating Model, and Worksource. Although the primary goal of digital transformation for a CSP is to create a customer-driven outcome through omni-experience, results from IDC’s Carrier Transformation Survey show this can be hard to attain. There are multiple hurdles on this journey, but there are two main obstacles. First, a lack of clarity and vision in a transformation strategy; second, finding the right people and working with them to guide this voyage from mere utility provider to technology and communications provider.

This difficulty to transform is against a backdrop of challenging business times for the overall communications sector. According to IDC’s Telecommunications Services Database H12017, the telecommunications sector will experience a flat growth rate of 1% in revenue, from $1.37 trillion in 2016 to $1.45 trillion in 2021.2

Though mobile services and broadband will continue to drive the industry, relentless competition from OTT players continues as individual domestic markets provide a wider, and deeper, range of customer-centric services and content.

Spending in the business and consumer segments will grow at roughly the same rate, with revenues split on a 70:30 consumer-to-business ratio. In 2016, mobile services made up 62% of the overall market, and this ratio will remain steady over the next five years. The broadband segment will grow from 15% of the overall sector to 18% in 2021.

In the Cisco Visual Networking Index: Mobile Data and Internet Traffic, 2016–2021, Cisco forecasts that over this time period mobile data traffic will explode at a compound annual growth rate (CAGR) of 46% globally.3 Particularly striking is that mobile video traffic will increase from 42,029 petabytes (PB) to 159,161 PB worldwide per month, reflecting a CAGR of 31%. In the context of increasing competition coupled with declining average revenue per user (ARPU) for mobile services, carriers must increase investment in bandwidth and coverage — especially in more densely populated urban areas — to satisfy universal demand for more connectivity at higher performance levels. The same report found IP video currently represents 77% of total data traffic, and this will surge as more content delivery networks, as well as always available content ubiquity, enter markets. YouTube statistics published earlier this year support this observation: videos uploaded on YouTube equal approximately 300 hours of content for each minute of the day, a staggering increase from only 100 hours in 2014. The democratization of rich content and the growth of social media have led to demand not only for download bandwidth to consume, but upload bandwidth too contribute.

These stories of the growth and the rising strength of OTT providers span the industry. According to Informa’s World Cellular Revenue Forecasts 2018, global annual SMS revenue will fall from $120 billion in 2013 to $96.7 billion by 2018, due to increasing substitution of SMS for messaging apps including WhatsApp, Skype, and WeChat.4 A report by Spirit DSP, “The Future of Voice”, examines the impact of OTT VoIP (voice over Internet Protocol) applications on voice revenue. According to the report, global telco voice revenues (including fixed subscriptions) will decline from $970.4 billion in 2012 to $799.6 billion by 2020, at a CAGR of 2.4 %. The increasing use of VoIP to drive voice across data connections will create a worldwide voice revenue drop of $479 billion by 2020, or 6.9 % of the total current revenue.

Globally, IDC’s Telecom Services Database shows that between 2017 and 2021, mobile machine-to-machine/IOT traffic will grow at 16.2% CAGR, while mobile data grows at a lower 7.1% and mobile voice decline 2.7% annually.5 Similarly, fixed data products Ethernet and IP VPN will grow at CAGRs of 5.5% and 4.5% respectively, but legacy data services will fall by 9.7%. Fixed voice services are forecast to decline 4.9 % annually, while IP voice will grow by 3.4% over the same period. Mature markets globally face greater pricing and revenue declines as carriers across multiple markets, including the United Kingdom, United States and Germany, cite double-digit percentage declines in renewals for connectivity contracts.

Satisfying Growing Digital Consumption Appetites

Among companies, IOT is expected to add an exponentially higher number of distributed connections to the enterprise network. Fueled by the explosion in remote and mobile global workforce personnel and the ongoing migration of enterprise applications, including SaaS, IaaS, and PaaS, to the cloud, the future enterprise network will be highly distributed, connect humans and machines to cloud-based applications, and will need to provision and allocate massive amounts of bandwidth to meet the demand required by cloud data services and PaaS.

Going forward, enterprise network traffic demand is limitless as business processes continue to digitally transform and as applications move even further toward mobility and the cloud. The challenge for the service provider is to deliver a high level of network access bandwidth while satisfying regulatory requirements and meet the high user experience expectations for new 3rd Platform applications that enterprise customers demand. And adding to this difficulty, service providers are expected to do this without substantially increasing the cost of the network infrastructure and connectivity to the enterprise. A hybrid wide area network (WAN) that incorporates all possible WAN connectivity options is no longer a luxury, but now a necessity needed to optimize application performance and improve efficiencies.

To meet all these pressures, GSMA Intelligence calculates that CSPs will have to increase network capex by a CAGR of 4.7% between 2013 and 2020 to satisfy consumer demand for bandwidth, largely fueled by video traffic.6

IDC predicts that by 2021, at least 50% of global GDP will be digitalized, with growth in every industry driven by digitally enhanced offerings, operations, and relationships, and that by 2020, investors will use platform/ecosystem, data value, and customer engagement metrics as valuation factors for all enterprises. Beyond this, IDC has identified three important characteristics for the digital transformation economy:

- Things are moving faster than previously predicted, and can be seen in adoption of DX, 3rd Platform technologies, expansion of the DX developer community, and deployment of augmented reality/virtual reality (AR/VR), and innovation accelerator technologies. But nowhere is this more evident than in the use of cognitive/AI technologies and information to drive improved engagement, operations, and decision making. Information and how it is used are core for success in the DX economy.

- Consumer engagement and scale is mandatory. Whether your enterprise touches consumers directly or indirectly through consumer-facing partners, competing will become increasingly difficult without connecting value to consumers, their homes, and their lifestyle (even for traditionally B2B enterprises).

- Ecosystems are as important as core IP. Maximizing leverage in all aspects of the enterprise through partner communities — developers; partners, competitors, and customers aggregating around industry collaborative platforms; and the emerging DX channel community — will determine much of the success in the DX economy.

The transformed organization is driven by a customer-centric and empowered workforce that embraces risk taking as it seeks to continuously innovate. Technology and data are its lifeblood, fueling more efficient operations, new revenue streams, and customer loyalty. The digital native enterprises leverage leadership, engagement, information, business/operating models, and worksource in an “outside in” approach to be a leader in their ecosystem and industry. They continually monitor and adapt to new information, opportunities, and threats while leveraging their ecosystem of stakeholders (customers, partners, employees, and community) to dynamically evolve products, services, and strategies.

As these overall transformational developments occur at the organizational level, other global patterns will directly affect the telecommunications industry. The world continues the move to urbanization, with the World Bank estimating 52.4% of the global population lived in urban environments in 2016, and this is forecast to rise to 65% by 2020.7 This shift is even more apparent in higher income countries, with average levels of urbanization reaching 81%, compared to an urbanization rate of 31% among lower income countries. An increase in urbanization will lead to new demands in society, including greater need for housing, healthcare facilities, and basic infrastructure. And this carries over into the telecommunications world, as well, as higher density requires greater network infrastructure to handle demand for greater levels of communication and connectivity — from the ability to share social media content to the need to improve and perfect public safety communication infrastructure.

On top of this overlay, the need for digital transformation in the telecommunications is even more apparent. Companies must make changes to their organizations to grab this next wave of growth, following an ever-stronger customer-centric approach to building improved business models, create business processes that are flexible and agile in responding to market opportunities, and offer a wide variety of affordably attractive and innovative services, such as streaming and on-demand video services over mobile networks. IDC has identified the following key benefits arising from operations transformation:

- Internal upsides: Within the organization, transformation leads to improved employee productivity, the rationalization of internal systems and processes, the breakdown of operational silos, the simplification of complex back end systems, and most importantly, reduction in cost of delivery.

- External upsides: Transformation brings about reduced time to deploy new products and services in the market while also expanding international offerings. It can help increase wallet share in existing markets and expedite offerings to new markets.

As carriers seek to build solid and durable connections with an increasingly fickle customer audience, transformation builds stronger bonds through enhanced customer engagement, faster time-to-market capability, and improvements in overall organizational agility and responsiveness to new revenue opportunities.

Carrier Opportunity in Digital Transformation

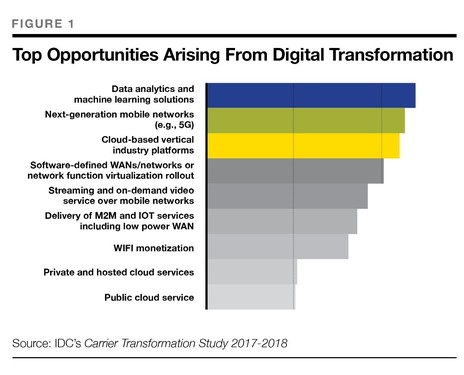

In IDC’s Carrier Transformation Study 2017-2018, carriers were asked to prioritize opportunities created by digital transformation. Topping the list at the worldwide level were opportunities around data analytics and machine learning, followed by next-generation mobile networks, and rounded out by cloud-based vertical platforms. The list of opportunities and their priority is shown in Figure 1.8

The evolving use cases for IoT are expected to drive volumes of data stemming from billions of deployed end points. Carriers must be able to capture that data by deploying network solutions to support low data use cases such as utility meters, agricultural environments and environmental data. Managing this data and acting upon it has been the domain of vendors like IBM with Watson, Cisco and their Jasper IoT platform, and Microsoft Azure platform, along with traditional analytics companies like SAS, SAP, and Oracle.

As noted above, the demand for mobile network services is forecast to grow exponentially, with carriers quoting doubling of demand for data across their mobile networks in tandem with sharply decreasing ARPUs from users. In an effort to deliver higher bandwidth to users along with lower latency and increased capacity and reliability, carriers are looking to 5G and accompanying technologies to attract more use cases to mobile networks and support further monetization through IoT and similar services.

Building on this concept is the delivery of purpose-built platforms for vertical industries. While general purpose platforms to support various use-cases have been in play for a number of years (including VDI, office productivity, UCaaS, and CRM), the ability to encapsulate pre-integrated solutions for businesses can remove some of the complexity around solution integration. Telefonica, for instance, has deployed a number of pre-integrated solutions aimed at vertical industries and targeting small to mid-size businesses. Similarly, Telstra and SingTel have packaged solutions to drive their value to the mid-market.

Regionally, some of these opportunities are more relevant than others based on market maturity, consumer perception, and technology deployment. In Europe, opportunities are more evenly spread across the spectrum, with WiFi monetization topping the list, followed by next-generation mobile networks, and data analytics/machine learning. The popularity of WiFi monetization in Europe may be a function of the overall saturation of mobile coverage and the use of WiFi across the region. Cloud-based vertical industry platforms reflect industry needs, including automotive in the European theatre, as players like Vodafone focus on enabling automotive telematics, entertainment, and insurance telematics solutions.

In EMEA, data analytics topped the list, followed by cloud -based vertical platforms, which are seen as a way to improve carrier penetration to key industries. Across the United States, South Korea, and Japan, the opportunities from IoT and next-generation mobile networks reflect carrier capability in these markets. For China carriers, opportunities in on-demand video streaming are high due to a strong consumer-centric focus. Software-defined networking functions contribute to delivering agility, which echoes customer facing and back office efficiencies.

Finally, across the rest of the world, carriers largely focus on launching public cloud services to monetize infrastructure investments.

In today’s hypercompetitive environment, carriers are faced with a choice: go utility or go technology. In the utility model, the CSP provides high speed, volume, cost-optimized voice and data services to stay ahead of declining pricing levels and delivering infrastructure and service that meets customer demands for flexibility, agility, and adaptable connectivity. On the other side, the technology model supports the development of a comprehensive ecosystem enabling the delivery of communications, security, cloud services, and other third platform applications, augmented by value added services around content delivery, and IOT.

Each model requires a complete transformation involving the streamlining of systems, processes, and people; the integration IT and operations technology, long segregated in carriers; and the destruction of data siloes combined with optimal aggregation, integration, analysis, and utilization of carrier network collected data. Supporting this transformation is a consistent set of vertical metrics from the top to the bottom of the carrier organization, and the encouragement of competition across lines of business (LOBs), satisfying a set of horizontal metrics.

Overcoming Obstacles on the Transformation Journey

Carriers need to conquer multiple challenges before reaping the benefits of digital transformation. Regardless of size, all carriers experience similar barriers, including lack of budget and scarcity of business cases, on the road to digital transformation. Beyond these, other challenges impact organizational leadership and culture, operations, as well as overcoming infrastructure constraints.

- Leadership challenges: Transformation advocates must gain buy-in and budget allocations from business units, manage expectations from leadership, streamline and change existing business processes, develop internal skillsets to facilitate, deepen, stabilize, and realize transformation across the organization.

- Operations challenges: Transformation advocates must understand the inertia inherent in tackling and transforming legacy back-office environments while managing conflicting transformation initiatives from across business units. Further impediments include limited buy-in from functional departments, overcoming the possible lack of a strong business case for change, an often shortage of streamlined solutions, and limited flow of information across organizational silos. Externally, complexities abound connected to understanding and responding to competitor strategy, ongoing changes in customer service delivery preferences.

- Infrastructure challenges: During transformation, the lack of system integration across multiple vendors can cause considerable headache. Above this, the restricted budgets and sometimes limited alignment of business objectives between IT departments and business units can feel like a brake on the trip. And of course, there is the complexity of the optimum migration strategy from the old traditional to the new digital infrastructure platforms. As the icing on the cake, there are also challenges around ROI expectations, skills management and retention, and the technical and management capabilities of partners, employees, and new platforms.

To achieve a successful transformation, carriers at the start of the journey must gain buy-in and develop a clear and rational business case for transformation among stakeholders within the organization. Beyond this, the transformation voyage must include a reliable and viable delivery roadmap, identify key milestones, measure progress at each stage, and concentrate on early savings before claiming revenue increases. Leaders must also:

- Align LOB goals to the organization’s strategy: Using cross-functional teams, build and align LOBs with new infrastructure platforms, and create service delivery processes that leverage existing best-of-breed solutions.

- Optimize communications: Establish communication protocols across silos. Smoothing and aligning business objectives and solutions across the conflicting interests of different functional units is critical to the success of transformation.

- Educate employees: Develop internal skills to build up the talent pool and retrain existing staff to master new technology and processes. Improve staff awareness around the benefits transformation will bring to overall future operations.

- Flexible infrastructure: Focus on virtualization at the core to deliver flexible, agile solutions across the organization.

- Measure progress: Understand the impact of change on systems, processes, and people while monitoring milestones of success for a phased and timely transformation. Carriers can also drive change more effectively by fostering healthy internal competition.

For an enterprise to digitally transform, it must achieve the five digital dimensions: leadership, relationships, information, operational, and talent. Below are questions that C-Suite leadership can ask themselves as they look to achieve digital transformation:

- Is the CEO and other relevant leadership involved in the transformation roadmap? Is the CEO driving cultural change down throw the organization?

- Is leadership proactive in setting the vision, determining an appropriate organization structure, and committing to an aligned amount of digital transformation resources?

- Is the organization oriented to “put the customer first”? What processes has the organization implemented to support the customers’ whole experience?

- Has the organization mapped out key customer segment journeys, including looking at customer devices and delivery channels, with an eye toward creating a better experience?

- Is there a strategy to integrate data collected from all customer touch points to create actionable and relevant opportunities?

- Is there a focus to optimize customer reach, maximize relevancy, and enable reciprocity?

- Is there a focus to develop business processes that can achieve scale, expand scope, and deliver speed in operations across the organization?

- Is there a strategy for talent acquisition — finding the right skills in the right people and clearly defining job roles?

- How is an innovative work culture being fostered across the organization? Is there a focus on work optimization and talent sourcing, with the aim of aligning processes, people, and the organizational culture?

- To what extent are partners’ expertise considered, particularly as it relates to skills sourcing?

- Is there a focus on rewarding, encouraging, and guiding personnel to re-skill in new IT capabilities?

- IDC’s Worldwide IoT Infrastructure Taxonomy, 2017

- IDC’s Telecommunications Services Database for H12017

- Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2016-2021 White Paper

- Informa’s World Cellular Revenue Forecasts 2018

- IDC’s Worldwide Telecom Services Database Taxonomy, 2018

- GSMA Intelligence

- World Bank DataBank

- IDC’s Carrier Transformation Study 2017-2018