Events of the last month are causing some boards to rethink the breadth and nature of corporate risk. From the Russian invasion of Ukraine and the fierce US and EU economic sanctions in response, to China’s turn inward as a clear priority of self reliance, the world has entered turbulent geopolitical times. Executives and boards now must consider broadening the potential scenarios they are evaluating regarding

geopolitical risks and their impact on the business.

Re-examine the Global Community Impact

- Are certain links in the supply chain vulnerable to geopolitical risks? Current global events provide an occasion to review how changing circumstances create different trade-offs among various stakeholders’ objectives in promoting geographically dispersed supply chains. Geographic concentration of manufacturers has the cluster advantages of sharing infrastructure and know how in a region, but puts production at risk from natural disasters, geopolitical events, and the pandemic. Certain supply chain links are more vulnerable and should be addressed within a solid risk management plan.

- How does the company protect itself from geopolitical risks? Boards need to start stress testing their businesses against the possibility of a much more fundamental change in the global economy. Global corporations and smaller enterprises should consider investing more in supply chain resilience, which requires introducing some redundancies and flexibility. Resilience may come from balancing efficiency (reducing cost, minimizing inventories, and maximizing capacity utilization) against building flexibility to absorb supply chain disruptions. See the five step suggestions below.

- Other things to consider:

- What backup plans need to be in place to protect employees and assets in areas vulnerable to military conflict?

- Do we need to consider a different means of talent development?

- What impact do recent events have on our company’s taking positions on various issues?

“Global geopolitical events more recently exposed preexisting vulnerabilities, which are being addressed by implementing an optimal trade off between different objectives.”

Get the Facts

Five Steps to Manage Geopolitical Risks

A study released by the Wharton Political Risk Lab identifies five steps boards can take to manage their geopolitical risks more proactively and strategically:

- Identify quantitative political risk indicators

- Develop or acquire the ability to assess the business impact of political risk

- Integrate political risk into enterprise wide processes

- Engage the board and C-suite to incorporate political risk into strategic planning

- Set up a cross functional geostrategic committee

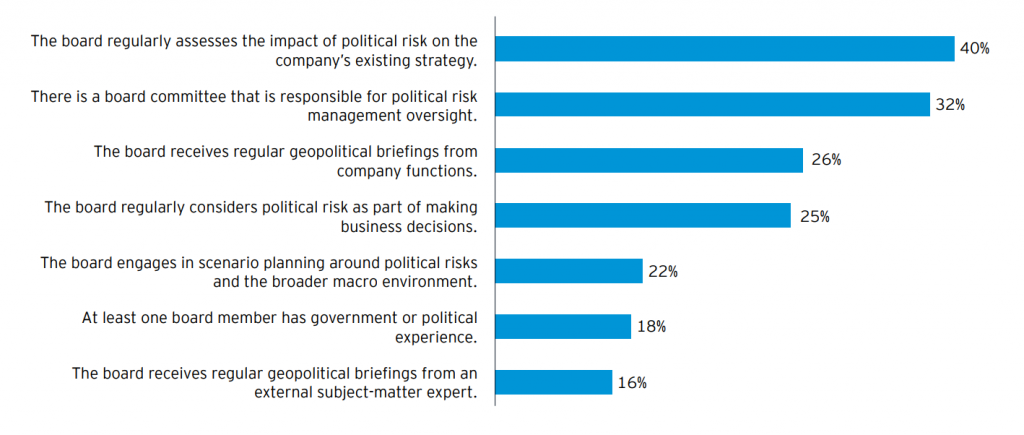

Boards are Reactive to Political Risk Management

Chief Takeaways

Companies will continue to face geopolitical tensions and shifting policies in 2022.

Targeted geostrategic actions can help boards position their companies for resilience and growth.

Supporting Your Board

At DHR, we stay on top of key trends impacting our clients and their businesses. We strive to keep our clients well informed, connected, and prepared for a future of value creation. Contact us if we can provide additional insight or service to meet your needs.

*EY Geostrategy in practice report 2021