If you want to get paid in a Wall Street investment banking division (IBD) this year, you’ll need to be lucky. Figures from Dealogic suggest Americas investment banking revenues fell 17% year-on-year in the first quarter. This might explain why banks like Bank of America and Goldman Sachs have seen big reductions in their M&A revenues, and most banks’ IBD revenues are down on 2017.

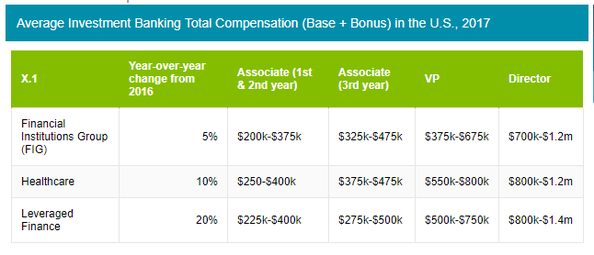

The slow start to the year on Wall Street comes after some of the hottest teams in the industry received pay rises for 2017. Figures from search firm Options Group suggest leveraged finance bankers, in particular, received an average 20% pay hike for last year. Directors in LevFin are now on $1.4m.

Gary McCool, a vice president at recruitment firm Selby Jennings, says LevFin bankers usually get slightly less on the bonus end when compared to coverage or M&A bankers. For 2017, that may have been different.

Carol Hartman, managing partner in the global financial services practice at DHR International, says LevFin bankers remain in strong demand this year, along with tech coverage bankers and financial sponsors bankers who work with private equity funds.

Financial Institutions Group (FIG) bankers received a more modest 5% pay hike for 2017, but could be paid up for 2018. As we noted before, demand for FIG bankers is being driven by regulatory changes like the Total Loss-Absorbing Capacity (‘TLAC’) standards, which mean banks’ outstanding bonds need to be refinanced.

“There has definitely been a higher demand for FIG bankers over the past six months,” says McCool.

Mike Karp, CEO of Options Group, says boutiques and Canadian banks are particularly active recruiters in the FIG space now.

Healthcare remains one of the biggest sectors for Wall Street dealmaking, ranking third behind energy and financial institutions in the first quarter of 2018, according to Dealogic. Healthcare fees rose year on year in the first quarter, after rising significantly in 2017. Options Group says average compensation in healthcare teams rose 10% last year. McCool says experienced associates and VPs in healthcare are in particular demand.