Keith Giarman

Managing Partner, Global Private Equity Practice

Private equity (PE) firms are navigating extended hold periods, elevated entry multiples, and intense pressure from investors to prove repeatable value creation.

In our previous article, Private Equity’s Value Engine: The Talent Operating Flywheel™, we introduced a framework for linking leadership decisions to value creation.

This installment explores how to activate that Flywheel – embedding a systematic, data-driven approach to talent that propels operational discipline and strategic momentum across the ownership cycle.

Capital efficiency alone no longer defines performance. PE leaders now compete on how effectively they deploy, develop, and align leadership capability with their value creation plans.

The Flywheel translates that intent into execution – providing a mechanism to anticipate leadership needs, accelerate integration, and sustain momentum through exit.

Value erosion often starts quietly. Post-acquisition turnover, slower-than-expected integration, and missed growth targets rarely stem from flawed financial models. Instead, they trace to misalignment between leadership capability and strategic intent.

Without a defined talent road map, PE investors spend critical months reacting to performance issues that could have been predicted. The Flywheel solves for this by positioning talent as a measurable driver of enterprise value within the broader investment plan.

In practice, that means beginning with a clear diagnosis of context and inflection point – where the company has been, where it is, and where it’s headed. Different situations demand different kinds of leaders. Across hundreds of portfolio mandates, five archetypes commonly define what “right leadership” looks like for a given value-creation strategy:

Mapping the portfolio company to its archetype clarifies which capabilities matter most and where leadership risk resides. It reframes assessment from “Who’s available?” to “What will it take to win in this context?”

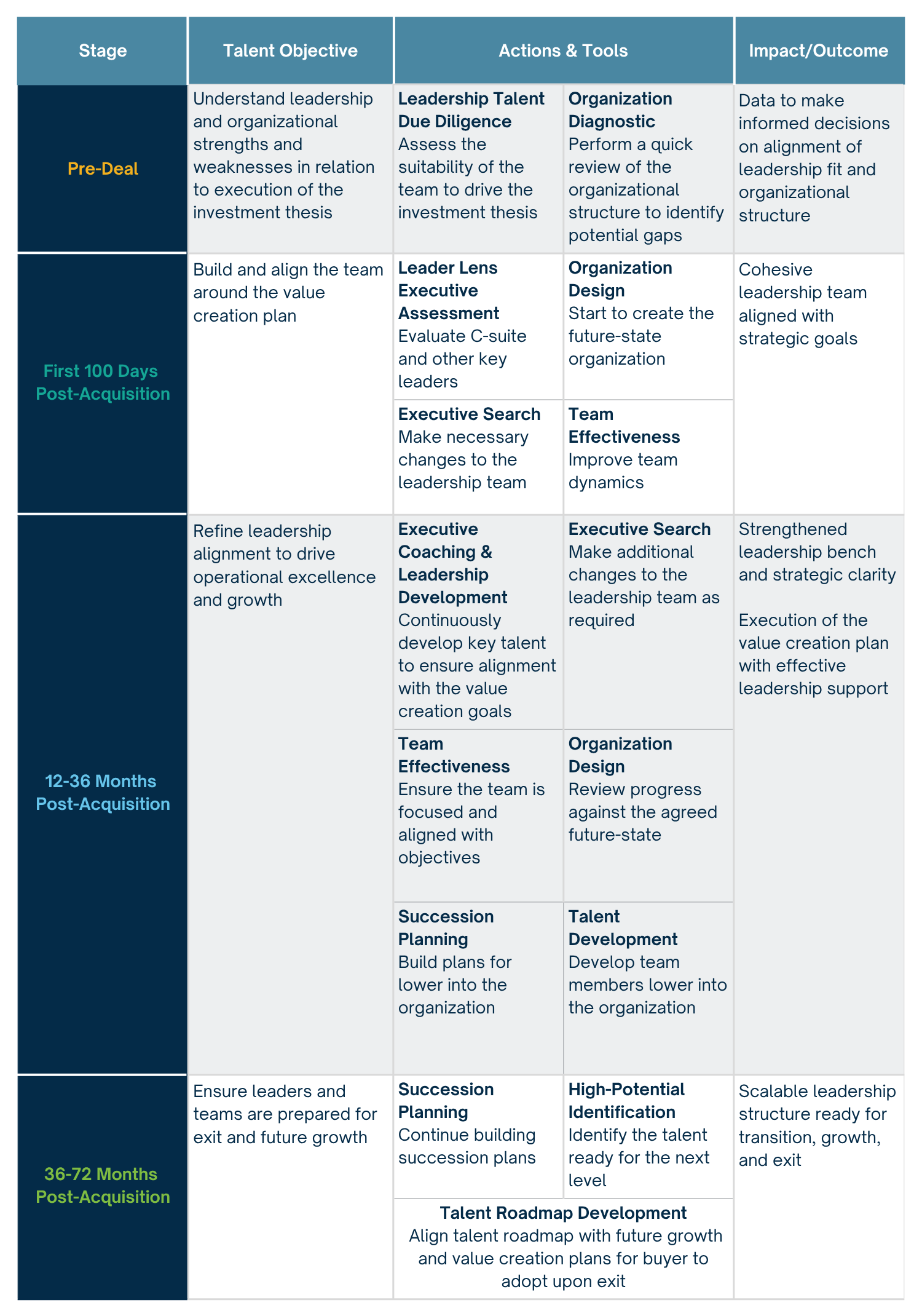

Activating the Flywheel requires more than replacing a CEO or tweaking a playbook midstream. It demands a continuous process that begins before the deal closes and endures through the full ownership cycle. When this discipline is embedded early, talent decisions align more with strategic priorities, creating a direct link between leadership capability and value creation.

A proactive approach anchors talent strategy in due diligence. By evaluating leadership readiness, organizational design, and culture compatibility early, investors can anticipate issues that would otherwise surface midhold.

Once the Flywheel is in motion, it creates a continuous feedback loop. Predictive data feeds succession planning and coaching; succession data informs future search mandates; and every talent decision is benchmarked against value-creation metrics. This discipline builds organizational continuity that outlasts market cycles.

Investors who embed this thinking early gain a portfoliowide advantage: they experience planned, stable leadership, efficient post-close ramp times, and a direct translation of strategic plans into operational execution.

At the core of this discipline is Leader Lens™, DHR’s multi-method assessment that combines behavioral interviews, Hogan personality inventories, 360-degree referencing, and the Leader Lens case study simulation to evaluate executive aptitude. The Leader Lens simulation-based assessment methodology provides a forward-looking view of executive performance. Unlike traditional interviews or self-report tools, it immerses leaders in scenarios that mirror portfolio realities and measures how they analyze, decide, and act under pressure.

Leader Lens evaluates three dimensions of executive intelligence – analytic, social, and emotional – to reveal how leaders balance judgment with influence and resilience. These capabilities now predict success more accurately than industry tenure or domain expertise.

Just as important, Leader Lens illuminates development opportunities that extend beyond a single role. By identifying how leaders can strengthen their decision-making, communication, or team-activation skills, the assessment enables targeted coaching and succession readiness. This dual predictive and developmental value creates a talent system that improves with each cycle of use.

For PE firms, that means consistent data on leadership quality across the portfolio, standardized decision criteria for search and promotion, and a clear narrative for limited partners about how human capital strategy contributes to returns.

Leader Lens is DHR’s proprietary executive assessment solution designed to evaluate leadership agility, decision-making, and long-term potential. It empowers organizations to make confident, data-driven talent decisions, whether selecting a CEO, developing high potentials, or strengthening the leadership bench.

The Flywheel only achieves full velocity when leadership strategy and investment strategy move as one. DHR’s integrated model – spanning leadership consulting, executive search, and Jobplex emerging leader search – connects those functions in a unified process that ensures every decision about people reinforces enterprise value.

This integration transforms what’s often a fragmented approach into a closed system of continuous intelligence. The same predictive data that informs selection also shapes onboarding, development, and succession. Each touchpoint feeds the next, compounding insight over time.

Within that system, leadership consulting establishes alignment between organizational design and strategic imperatives. Executive search brings market calibration – benchmarking talent against external standards. Jobplex extends the reach downward, identifying high-potential leaders who are ready to move into mission-critical roles. Together, they keep the Flywheel turning at every layer of the portfolio.

The result is a portfoliowide leadership engine that anticipates capability needs rather than reacting to them, creating stability in the present and strength for what comes next.

Waiting to address leadership until challenges appear is costly. Activating the Flywheel early – ideally before closing – creates momentum that continues through each stage of ownership. It allows PE firms to evaluate leadership readiness, align organizational design to strategic priorities, and plan transitions well before they become urgent.

The return is measurable: shorter ramp-up times post-close than the industry average, fewer unplanned leadership changes than historical averages, and improved value creation narratives at exit. By treating talent as an operating discipline, investors reinforce the same rigor they apply to capital allocation and strategy execution.

The Flywheel delivers its greatest value when it translates leadership discipline into measurable business outcomes. Across diverse investment strategies – buy and build, rapid growth, transformation, and exit readiness – the framework accelerates execution, compresses decision time, and strengthens valuation narratives. The following examples illustrate how the Flywheel accelerates performance across distinct investment scenarios.

In a manufacturing company that’s executing a buy-and-build plan, growth through acquisition outpaced integration. Leadership misalignment produced fragmented operations and eroding margins. If it were embedded earlier, the Flywheel process would have provided predictive assessment data on leadership readiness and stress points, signaling when the CEO and chief financial officer capabilities no longer matched the firm’s new complexity.

Applying the Flywheel at diligence would have clarified which leaders could shift from entrepreneurial to operational execution and which required transition. The result: preserved cash flow, accelerated synergies, and an expedient path back to covenant compliance.

Another portfolio company reached an inflection point where structure hindered execution. A recent acquisition expanded geographic reach and product lines, but accountability blurred. Through the Flywheel, the investor applied organization-design benchmarking to map a future-state structure centered on profit and loss (P&L) ownership and regional leadership.

Talent assessments revealed where leadership depth existed and where new capability was required. Implementing the redesign closed gaps, improved efficiency, and aligned incentives with strategic goals, improving profitability and creating a platform ready for continued expansion.

In preparation for exit, another company showed strong performance but lacked a credible succession plan. Buyers assess not only current results but also the durability of leadership. Using the Flywheel, the firm evaluated each P&L leader and functional head, clarifying who met future performance requirements and who needed development or transition.

That disciplined approach produced a transparent road map, reducing perceived transition risk and increasing buyer confidence. The company ultimately achieved a premium multiple, driven not just by numbers but by the assurance of leadership continuity.

The most sophisticated PE firms no longer view talent as a reactive function. They recognize it as a continuous operating system: a Flywheel that links strategy, execution, and valuation across every ownership phase.

Activating that system demands discipline: assessing leadership contextually, embedding data into every decision, and maintaining alignment between the CEO, chief financial officer, and chief human resources officer – the triad most critical to performance. When these roles operate in sync, the entire organization moves with purpose and precision.

The return is significant: minimal leadership disruptions, strong engagement scores, robust operating margins, and accelerated time-to-value following acquisitions. More importantly, firms build reputational capital with limited partners by demonstrating a repeatable method for translating talent into returns.

Every portfolio company has its own story, shaped by its archetype – Commercial Growth, Market Innovation, Purposeful Transformation, Rapid Turnaround, or Sustainable Scale. The Flywheel gives investors the framework to align leadership to each one and the tools to sustain that alignment.

DHR’s integrated approach provides the infrastructure and insight to make that possible. Investors who adopt this mindset see talent as the ultimate compounding asset.

Watch for the next article in this series, along with a webinar, where we will share further insights into the connection between talent and value creation.

DHR’s Private Equity Practice Group partners with clients to embed leadership discipline across the ownership cycle. In collaboration with our Leadership Consulting Team, our experts deliver the insight and tools to make talent your ultimate value driver. From due diligence through exit, we help you anticipate leadership needs and sustain momentum. Contact Keith Giarman or Daniel Hall to learn how we can help you elevate your talent to support measurable returns.