On Thursday October 26, 2017 in Sausalito, CA, at the Cavallo Point Inn — a historic landmark overlooking San Francisco and the Golden Gate Bridge — nearly 40 professionals from the Private Equity community convened to address and discuss human capital best practices.

The conference explored human capital topics that impact the achievement of the value creation objectives of portfolio companies sponsored by PE firms, including the structure and performance of their management teams and Boards, identifying and recruiting top talent, key attributes of top-performing CEOs, and other issues. The day included sessions moderated by DHR where industry experts, operating executives, and investors engaged amongst themselves and with the audience on pertinent issues. The sessions were spirited and engaging where participants freely shared their views appropriately.

Keynote Address: Women in the Workplace

Presenter: Alexis Krivkovich, Managing Partner, Silicon Valley Office, McKinsey & Company

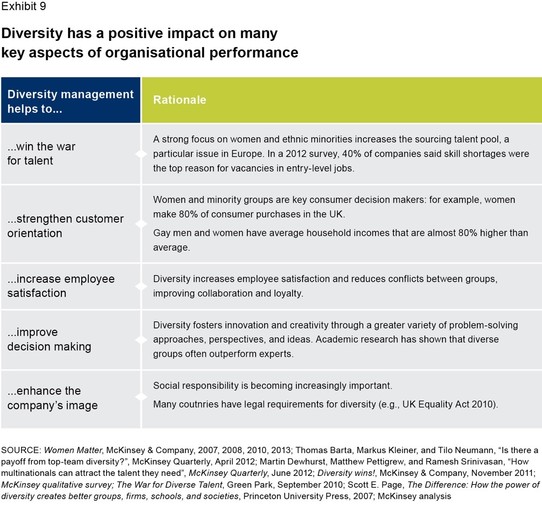

The conference kicked off with a thoughtful and inspiring Keynote Address from Alexis Krivkovich that put forth the facts about the lack of women in leadership roles today and, importantly, “unpacked” why we are not making progress faster. Astoundingly, according to the McKinsey research, “Corporate America is not on a path to diversity. At current rates, it will take 100 years to reach gender equality in the C Suite.” While the need for more gender diversity is generally accepted as a critically important objective, the reason it is important extends well beyond moral platitudes. The presentation quoted the head of talent for a Fortune 500 company: “It is not about being politically correct or nice. Diversity is going to be imperative because it’s critical for our economy and talent pipeline.” Ms. Krivkovich further made the case that gender diverse and ethnically diverse companies are 15% and 35% more likely to have above industry median performance. This is very much in line with ongoing sociology research that has continuously demonstrated that diverse groups make better decisions. Diverse companies’ outperformance is also logical when considering market structures. Women control 92% of the spending on vacations, 91% of the spending related to the home, 60% of the spending on automobiles and 51% of the spending on home electronics. McKinsey estimates that if women could achieve “parity” with men, it would potentially unleash $28 trillion of economic benefit worldwide and $2.1 trillion in the United States alone (yes, trillion!)

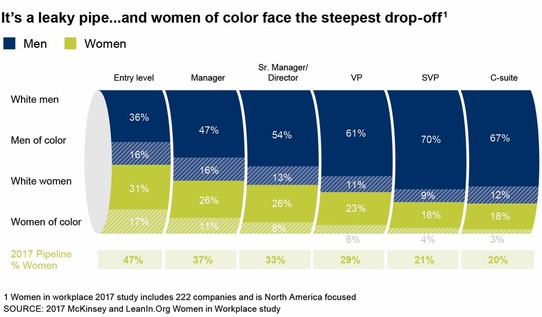

Rather than explore too many other details of the presentation in this White Paper, we refer you to www.womenintheworkplace.com where you can view and download the full report. On the other hand, we want to summarize the key recommendations of the report on how to stimulate change in your organization or the companies in your portfolio. When diagnosing the reasons why women are underrepresented in key leadership roles, one must examine in depth the “pipeline” of talent and their potential to progress into managerial roles. It is irrefutable that women have more difficulty than men in securing their first managerial role and the statistics are even more worrisome for African American women; this begins a cycle where there are simply not enough women moving through the ranks to take on higher levels of responsibility.

So, what can companies do about this problem to really establish momentum in making sure more women move into management positions faster? (It would certainly be nice if it didn’t take 100 years!)

Make a compelling case for diversity

- We claim diversity is a priority but employees don’t buy it

- How to make a compelling case for gender diversity

- Articulate a business case and back it up with numbers

- Get leaders on-board and ensure gender diversity is a priority for senior leaders

- Encourage an open dialogue where the importance of gender diversity is discussed regularly

“It is so enjoyable to be part of this conference and interact with the people who attend. The presentation on gender diversity was eye-opening and the other topics were thought-provoking and highly relevant to issues we face in the market and portfolio every day.” – Katie Solomon, Managing Director of Human Capital, Genstar Capital

Invest in more employee training

- Employees and managers would benefit from more training

- Only 47% of employees know what to do to improve gender diversity

- Develop and promote skills-based training

- Raise awareness of bias with “unconscious bias” training

- Require employees to attend, especially key decision makers on the front line of reviews and hiring

- Focus on building specific skills, notably teaching employees to work with diverse sets of individuals

Give managers the means to drive change

- Top performing companies help managers help women and men navigate difficult situations and recommend them for new opportunities more frequently

- Managers play a critical role in companies’ gender diversity efforts

- Give managers visibility into the scope of the problem and the tools they need to succeed

- Teach managers why gender diversity is important

- Develop formal sponsorship and mentorship programs

- Create an expectation for managers to raise gender diversity and address issues with their teams

Ensure that hiring, promotions, and reviews are fair

- Top performing companies are more likely to have dedicated programs to improve promotion rates for their employees

- Few companies have comprehensive end-to-end processes in place for hiring and promotions

- Strengthen your policies and programs to encourage gender diversity in hiring and promotions

- Use blind resume and analytics to reduce bias

- Evaluate criteria used for screening and personalize performance reviews

- Ensure a diverse slate of candidates and focus on high potential candidate pools

Give employees flexibility so they can fit work into their lives

- Top performing companies are more likely to have extended parental leave and on-site care

- Develop support for those in dual-career relationships

- Offer support to help employees balance work and family

- Signal acceptance of flexible working styles

- Develop childcare services to help working parents

- Offer extended parental leave programs to smooth the transition back

Focus on accountability and results

- Top performing companies are more likely to share diversity metrics with employees

- Although many companies track metrics, very few set targets

- Place emphasis on tracking, targets and transparency

- Identify metrics and gather data

- Decide where you want your company to be

- Communicate progress to employees to drive accountability

Importantly, top performing companies are seeing results

- 5X faster promotion rate for women across the pipeline

- 2X more women in C Suite, SVP and VP level roles

- 80% more women managers

- 15% more men committed to gender diversity

*Results based on top-performing vs. bottom-performing companies

SOURCE: 2017 McKinsey and LeanIn.Org Women in the Workplace study

Emerging Trends for Private Equity Boards: The Importance of the Executive Chair in Aligning Board & Management Team in Pursuit of Value Creation

Moderator: Mike Magsig, Managing Partner, Board & CEO

Private Equity firms are embracing with increasing frequency the concept of the Executive Chair in their portfolio companies. The rationale for this growing trend can vary, but all such initiatives are driven by the opportunities inherent in the business strategy for enhanced value creation. On one end of the spectrum, certain firms always engage in a transaction with a Chair in mind as part of the deal or to be deployed soon after. On the other end, certain firms see the need as more situational depending on the state of the company, the capabilities of the CEO and the effectiveness of the overall management team in achieving business and financial objectives. For example, in situations where the Board hires a CEO without direct industry experience, it can make sense to complement him or her with more of an industry expert in the Chairman role. Many other situations can dictate that PE investors consider deployment of an executive Chair. The panel addressed:

“This is the second conference sponsored by Keith and the DHR team that I have attended. What continues to impress is the engagement of the entire group as we share and wrestle really tricky human capital issues. Very cool indeed” – Peter Weber, Chief Executive Officer, Curvature (PE sponsored by Partners Group)

- The reasons for this emerging trend

- The impact the role can deliver

- Delineating responsibilities between the CEO and the Executive Chair

- Sources of potential Executive Chair talent

- Compensation

Key Findings

The role of Executive Chair has gained growing acceptance and greater use with Private Equity portfolio boards in the last five years. Its use in public companies during the same period has declined.

Public company governance and the analyst community in the UK are more accepting of the Executive Chair model. In the U.S. in particular, the concept is viewed more favorably in CEO succession transition when the former Chair & CEO, generally longstanding, is retiring as CEO, and the Board desires to retain the executive’s services for a pre-determined period of time. Otherwise, U.S. public companies with Executive Chairs are viewed negatively as the Board and leadership team may not be adequately addressing operational issues. As PE firms hold their assets longer striving for liquidity to meet investor thresholds, we are seeing more and more situations where an Executive Chair can make sense.

Reasons for increased acceptance in Private Equity include mentoring talented young portfolio company leaders; pre-IPO positioning; guiding the integration of recent acquisitions, etc.

Private Equity companies have the “luxury” of addressing certain matters without public scrutiny and, therefore, can pick and choose situations where supplementing the CEO and team with another capable C level operating executive can make sense. They can deploy resources to maximize value creation without concern for the scrutiny that is part of the public company reporting process.

Executive Chairs may be drawn from Private Equity Advisory Boards, former CEOs in related businesses or from the ranks of retired, seasoned Board Directors.

“The content of this conference was quite relevant to the issues we face working with portfolio companies and the engagement of the participants was impressive. It is gratifying to see a group of PE industry players brought together to share their experiences on talent, Board and management team effectiveness and delve deep on issues that affect our operational performance.” – John Knoll, Managing Director & Co-Founder, Oval Partners

Generally speaking, Executive Chairs are individuals that the PE firm is already well-acquainted before the appointment. In almost all cases, PE firms build a “bench” of talent useful in all kinds of situations — deal sourcing, due diligence, etc. — including adopting a Chair role when required. Considerable attention is given to placements with the right fit — culturally and for attaining the objectives.

Executive Chairs may take on operating roles in the event of CEO turnover.

In situations where the CEO’s performance does not match investor expectations, PE firms generally move quickly to address the issue with a leadership change. It is not uncommon for the Executive Chair to more quickly grasp the challenges and to have gained the respect of the leadership team making remedial action potentially more successful. Thus, they can be logical successors in these situations.

Compensation for Executive Chairs can range from 1.6 – 2.5 times the remuneration paid to a non-Executive Chair.

The variance in compensation can be a function of the time commitment and/or the immediacy and significance of the challenges to be addressed. A portion of the additional compensation may be in some form of equity participation.

Ideal Profiles for C Level Leaders: Competencies, Skills & Trade-Offs based on Value Creation Objectives

Moderator – Jeff Cohn, Managing Partner, DHR Elevate

Jeff Cohn, head of leadership advisory services at DHR, and Neel Bhatia, Managing Partner at Green Peak, highlighted “must-have” attributes in top-performing CEOs. Importantly, these research findings resulted from dozens of conversations with top principal investing firms and their partners around the country. In other words, the research resulted in a real-world summary of the observations of private equity professionals regarding what competencies and skills are most critical to ensure a CEO will work well with the PE firm, create high performance teams and optimize value creation every step of the way. Related to the above, this panel considered and addressed situations where CEOs without direct industry experience — the so-called “business athlete” — is preferred over an incoming CEO with experience relevant to industry, including product and market. As revealed in the conversation with the audience, the trade-offs here can be tricky and there is a perception — rightly or wrongly — that industry-literate executives can move faster in many cases. The discussion also underscored the need for certain provisions when opting for a CEO who does not have industry experience, namely accelerating the learning curve and assimilating the CEO quickly onto the Board and the team. These issues are important to consider during the recruiting process and once a new CEO is installed.

“Private equity investors need recruiters who can find value creators who know it’s the softer leadership and team building skills that really make the difference. It was encouraging to experience the dialogue at this conference with my friends at DHR where those skills were the center of attention.” – Neel Bhatia, Leadership Assessment Expert (former CEO, Green Peak Partners)

Key Findings

The presentation from Mr. Cohn and Mr. Bhatia emphasized five key points when considering the ideal attributes of CEOs who are most effective in their overall leadership skill and ability to drive value creation.

Experience is overrated.

When filling a CEO position, there’s comfort in hiring someone with prior CEO and industry experience. But the first criterion can dramatically narrow the pool, and the second can yield candidates who are so familiar with the industry that they’re hidebound or likely just to recycle the strategic playbook from their last job. Similarly, overemphasizing quantifiable success in prior positions can be misleading, because results are often a function of “right place/right time” or organizational or team factors rather than one individual. And even within an industry, different competitive positions can demand very different skills-cost cutting versus product innovation versus business model change, for instance. Many of the participants in the study undertaken by Mr. Cohn and Green Peak, said that over the years, they’ve become more open to “nontraditional” candidates who lack degrees from blue-chip schools and haven’t checked the usual boxes in a career progression.

Mr. Cohn notes: “Past accomplishment and current challenge is rarely an apples-to-apples comparison. You will need someone who can come into a new situation and pick up the fundamentals quickly. A great athlete is more important than someone with years of experience in a specific industry.”

Team-building skills are paramount.

Of the dozen or so attributes included in the survey, the highest ranked was a candidate’s ability to assemble a high-performing team. That makes sense, because many PE investments involve turnarounds in which the new CEO must completely rebuild the C-suite. And, because PE portfolio companies are typically smaller than publicly traded companies, CEOs spend more time in the trenches working alongside subordinates rather than providing autonomy with loose supervision. To avoid leaders who won’t excel at building teams, PE execs say, they watch out for candidates who use “I” too much when talking about accomplishments or who display so much intellectual horsepower that they come across as arrogant, which can inhibit hiring and developing A-level talent.

Mr. Giarman notes: “The best way to de-risk an investment decision when buying a company is to find a company with a great CEO and management team already in place that know how to work together. Of course, installing a great CEO who can bring familiar executives with him or her and / or attract top talent that fits the culture is critical to success in every business situation. Building value is a team event; it takes more than a great CEO and the CEO must understand this.”

Urgency outranks empathy.

PE firms operate with strict timetables for when a company should be improved and the investment recouped through sale or IPO. (The typical goal is five years.) This ticking clock means that a portfolio company CEO can expect close oversight and faces heightened expectations about the speed with which cost cuts or revenue growth will take place. Many CEO wannabes will balk at a PE-driven pace, particularly those who have grown accustomed to plusher, more heavily resourced environments. While this doesn’t mean that a CEO shouldn’t listen to customers or show concern for employees, it does require moving decisively and without regrets.

Mr. Bhatia notes: “Often, empathy needs to take a back seat to urgency. Empathy is critical but it obstructs the most efficient path to value creation when empathy turns into too much personal compassion. Some highly empathetic leaders are not able to make the tough personnel decisions that need to be made. While difficult given the implications for some who cannot maintain a PE-driven pace, the strategic and organizational needs of the business are the priority.”

Resilience is a must.

Parents understand that building resilience in children is important to character; PE professionals also cite it as an important leadership virtue. They are skeptical about candidates who have skipped seamlessly from success to success. It is important to find leaders who have faced setbacks, made errors, and perhaps even run adrift, yet regrouped, established the correct path and drove the business to a successful outcome. This attribute is especially important because in turnaround or change-management situations, leaders are likely to encounter some negative results.

Mr. Magsig notes: “Business plans never go the way you think they will. Beware of the rock-star CEO who has never failed, because business plans rarely go the way you think they will. If an executive hasn’t failed at something, they’re either lying or they haven’t pushed themselves hard enough or they don’t have the learning capacity to grow as a leader. We always probe deeply about past failures when interviewing CEO candidates. If a CEO can’t be vulnerable and share past failures, you should likely look for a different candidate who can.”

Authenticity, translated as candor, is also key.

Like “resilience,” “authenticity” has become so overused that its meaning can be vague. When one drills down, you find that PE executives use it to mean candor and a willingness to deliver bad news quickly, honestly, and transparently. In a public company, sharing negative information is a delicate process-it’s likely to move the stock price-but in a PE company, real-time sharing is critical given the need for urgency as the team drives towards goals mutually aligned with the Board.”

Mr. Pocs notes: “The most effective CEOs shoot straight and work in tight partnership with their PE colleagues. They want executives who are confident in sharing the good, the bad and the ugly with brutal transparency as they drive towards continuous improvement in the business.”