As companies begin the recovery from the pandemic, the most capable leadership will prove a crucial factor in the ability to survive and thrive. The following article provides suggestions, based on DHR’s significant client experience with the boards of private equity firms, on how independent chairs can help boost the performance of portfolio company CEOs.

The concept of adding greater diversity to corporate boards has been widely embraced for a number of years, evolving from merely adding directors of previously underrepresented groups to a now broader definition of diversity that reflects a diversity of thinking. In practical terms, this translates into adding directors whose skills and experience add new perspectives while complementing the company’s strategy.

Most recently, we are observing an interesting twist on this approach by private equity boards. They are taking the diversity of thought approach a step further and, in doing so, are killing two birds with one stone: breaking up groupthink on what are traditionally insular, homogeneous boards while also enabling boards to enhance leadership development resources, specifically for the CEOs and the executive team of portfolio companies. With these dual objectives in mind, private equity boards are recruiting outside board members to serve as the Executive Chair.

Private equity boards are proactively seeking to elevate the performance of their CEOs by assessing gaps in their skills and crafting an innovative, successful approach to closing these gaps.

Beyond the traditional role

The traditional, circumscribed role of the board generally accepted in governance circles is one of oversight and guidance, which stops short of treading on CEO and senior team turf of actual management or operations.

But the management-governance line is less distinct at private equity firms vis-à-vis their portfolio companies than at most other companies. Because private equity boards don’t operate under the same constraints as public company boards—whether from a listing, compliance, or regulatory perspective—they have the latitude to put their “fingers in” to address what they view as vital issues that may affect the value of portfolio companies in ways other companies would deem too intrusive.

Effective leadership is fundamental to the optimal functioning of any enterprise. Because private equity boards can have more expansive involvement in portfolio company boards, we note that these boards are proactively seeking to elevate the performance of their CEOs by assessing gaps in CEO’s skills and crafting an innovative, successful approach to closing these gaps.

Boards can focus on what they do best—ensuring the greatest financial return—while fostering the longer-term leadership development portfolio companies need to thrive and generate value.

An outside chair who can boost CEO performance

Increasingly, we are seeing private equity firms recruit executive chairs from outside the world of private equity onto the board. In addition to fulfilling their responsibilities as board leader, these experienced executives can apply their broad operational skills acquired successfully building a company as a mentor and coach to enhance the effectiveness of the CEO.

As these relationships between the CEO and the independent chair evolve, we have seen the CEO come to consider the chair a confidant with whom he or she can share challenges confronted in the role, because the chair has faced similar challenges. This can be particularly useful for a new CEO, who may not be comfortable airing these issues with the entire board or even with a private equity partner.

This approach represents a win for the board and for the portfolio company, too: the ability to inject needed diversity of thought into private equity boards while adding required skills to enhance the leadership capabilities of portfolio company CEOs and, thus, their potential to contribute to value creation. In this way, private equity boards can focus on what they do best—ensuring the greatest financial return for investors and for themselves—while also fostering the longer-term leadership development portfolio companies need to continue to thrive and generate value.

Case in point: An independent director adding value to the board and the company

A recent search we completed for an outside board chair for a private equity client illustrates this trend and the recruitment process, as well as the benefits that accrue to the board and the company.

The board of a portfolio company, specializing in health information technology, had some concerns that the company they had recently acquired, while performing well, had a relatively young, inexperienced CEO. They asked DHR to recruit an independent board chair who could act as a mentor and sounding board for the CEO.

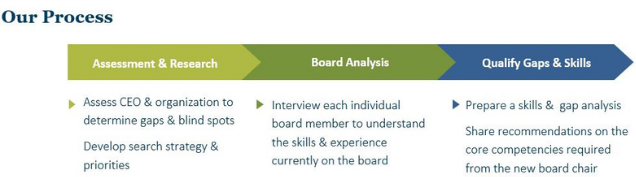

DHR’s first step was to meet with the CEO to understand what he believed would add value to his performance in the CEO role. We then interviewed each individual board member to obtain a clear picture of the skills and experience currently on the board. Next, we prepared a skills and gap analysis and presented our recommendations to the board on the core competencies required from the new board chair.

In considering the optimal solution, our recruitment recommendations went somewhat further than the board’s initial expectations. In addition to seeking a seasoned CEO, we looked for an individual who had been a first-time CEO in a private equity company. We also secured an individual with deep domain knowledge and, as requested by the CEO, one who had completed extensive joint ventures in the industry.

While undertaking the current board analysis, director profile, and search for candidates, our cross-industry expertise enabled us to look well beyond the private equity arena, eliminating any blind spots. And given our vast network and database, we were able to suggest a range of solutions and prospects that would not likely have been on the client’s radar. Finally, our facilitation of the board’s selection discussion ultimately led to a timely consensus.

The upshot

DHR’s disciplined, well-honed assessment process engaged the entire board in a search for the right chair. Moreover, an in-depth assessment of the CEO’s strengths and development areas ensured the right support for the CEO at the right time. This work has proven a significant factor in both the CEO’s and the portfolio company’s success: over a two-year period, our client saw the valuation of this company double. They have since exited the investment with a very favorable return to investors while setting the new owners on a path to a successful future with a strong leadership team.